Answer

Feb 28, 2014 - 12:00 AM

Hi Susan,

Thank you for your question about TOPS 1099 Forms.

The TOPS 1099-Misc is the right form for non-employee compensation, i.e. contractors.

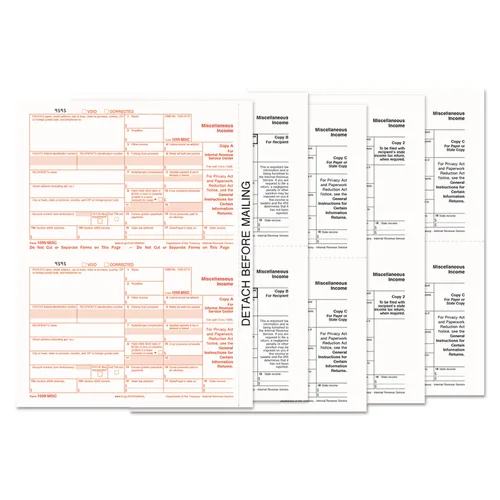

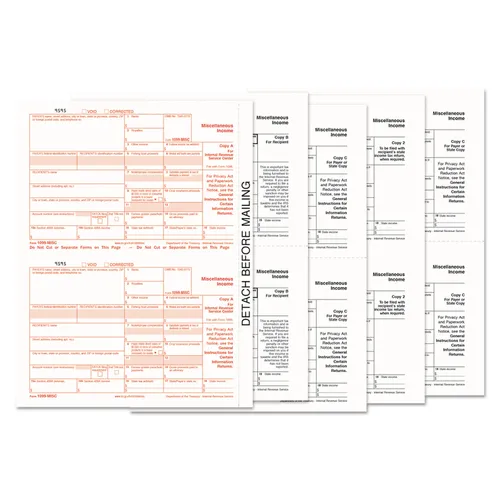

These five-part form sets include:

- One Copy A: Payer sends to IRS

- Copy B: Recipient sends to IRS

- Copy 2: Recipient sends to state reporting agency.

- (Two) Copy C: One copy for payer records, one copy for payer's state reporting agency.

One final note: 1099-Misc forms are dated and updated every year, so you can't just order a bunch and use them year after year. Only get as many as you'll need for this year.

Hope this answers your questions!

Best,

Frankye